Tax Liens Public Records

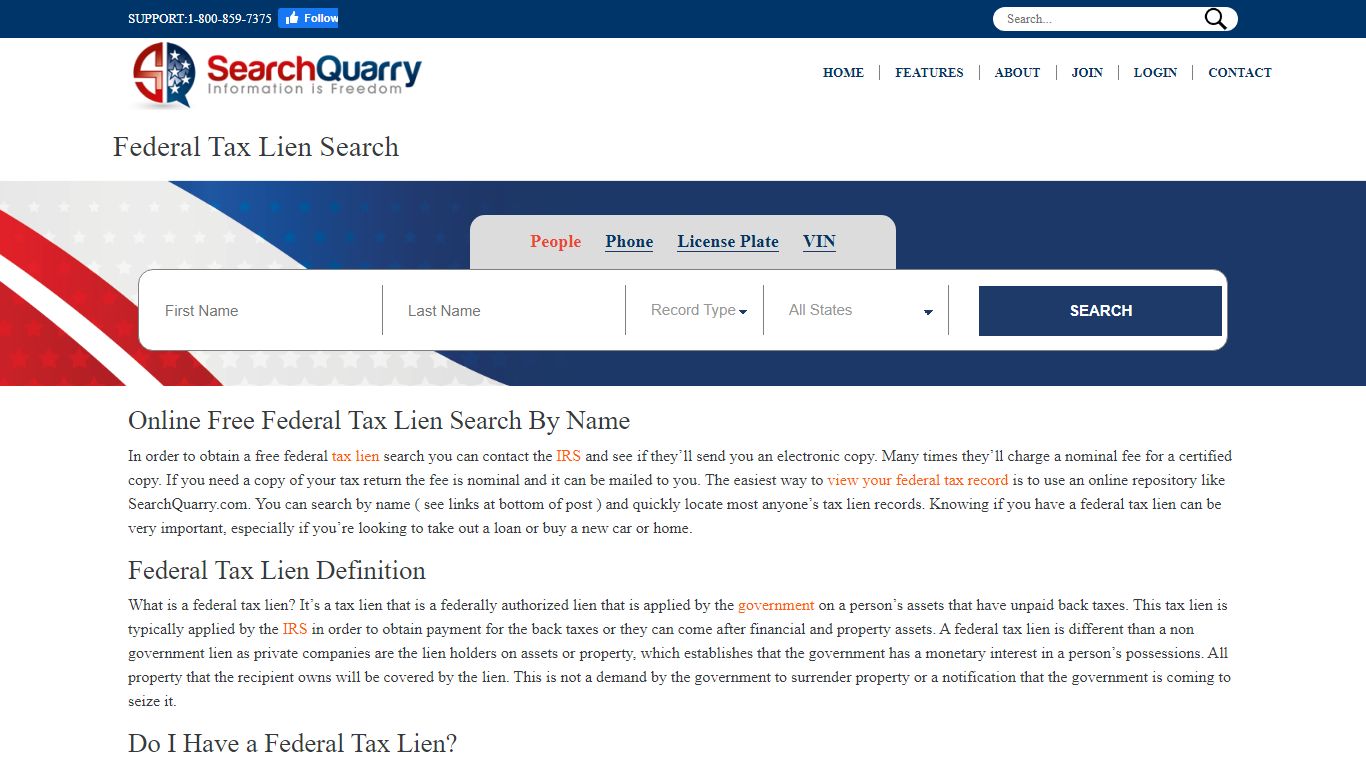

Free Federal Tax Lien Search - SearchQuarry.com

They typically take 30 to 45 days to remove the tax lien from your public record. It is also best practice to follow up with the major credit reporting agencies to insure they’ve received the release of your tax lien. This can affect your ability to obtain credit, or buy property if the lien is on your credit report.

https://www.searchquarry.com/free-federal-tax-lien-search/

How to Remove a Tax Lien from Public Record | Community Tax

If you need to figure out how to remove a state tax lien from public record, we have you covered. Removing one from public record can be fairly simple if you follow these steps: 1. Request a Copy of Your Credit Report When you receive a copy of your credit report, find the lien.

https://www.communitytax.com/tax-blog/removing-a-tax-lien-from-public-record/Understanding a Federal Tax Lien | Internal Revenue Service - IRS tax forms

Taxpayer Advocate Service — For assistance and guidance from an independent organization within IRS, call 877-777-4778. Centralized Insolvency Operation — If you are questioning whether your bankruptcy has changed your tax debt, call 800-973-0424. Contact the IRS — Individuals (Self-Employed) 800-829-8374 Individuals (Other) 800-829-0922

https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien

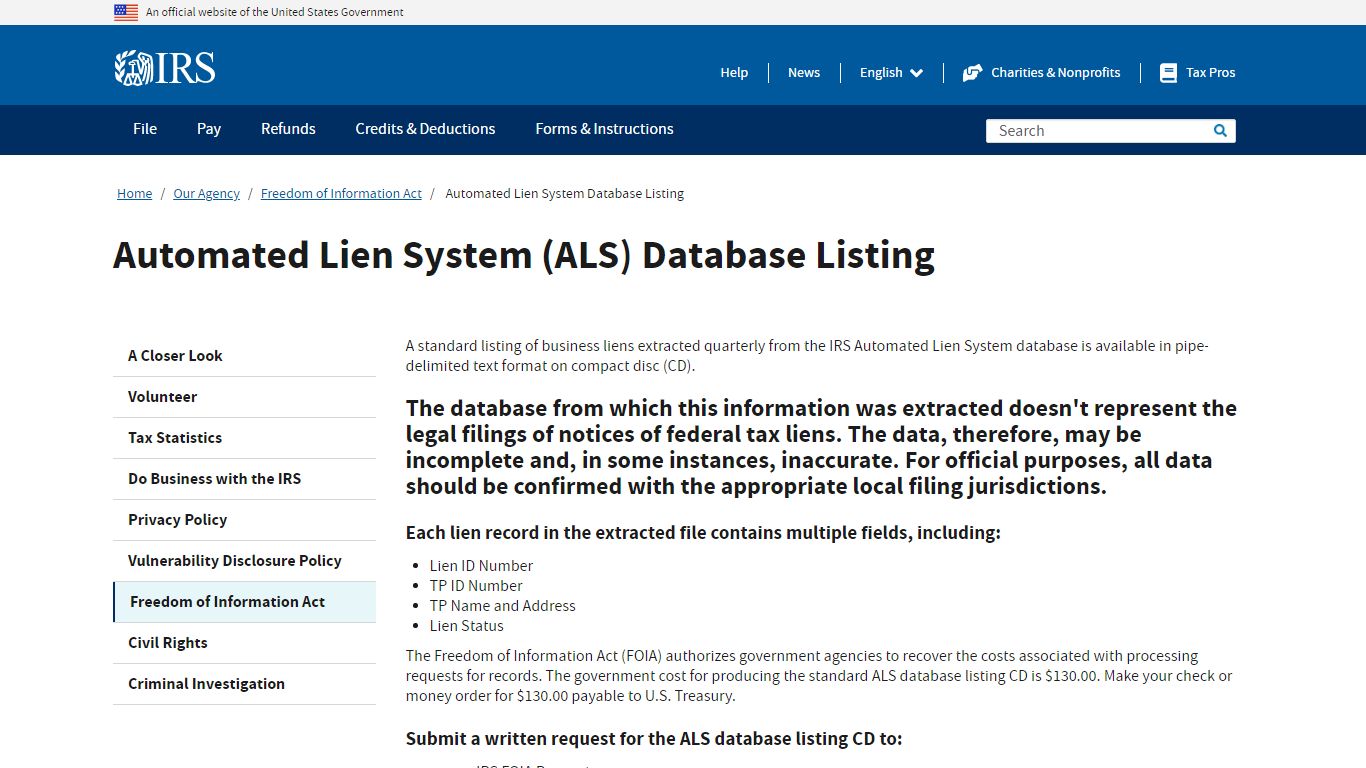

Automated Lien System (ALS) Database Listing - IRS tax forms

Each lien record in the extracted file contains multiple fields, including: Lien ID Number TP ID Number TP Name and Address Lien Status The Freedom of Information Act (FOIA) authorizes government agencies to recover the costs associated with processing requests for records.

https://www.irs.gov/privacy-disclosure/automated-lien-system-database-listing

Liens Search | StateRecords.org

In many cases, a lien becomes part of the public record, and anyone who plans to purchase or refinance that property must be informed about liens against it. The type of lien, the date recorded, and the amount owed are all made part of the record in what is known as a "Liens" index. If a lien exists, it will be in this index.

https://staterecords.org/liens

Foreclosures and Tax Lien Sale Records Search Directory

Tax liens are incurred by non payment of real estate taxes. A tax lien sale is a sale conducted by a government agency of these liens and those that buy them must wait out a redemption period during which the homeowner may repay the lien and any interest. Once this period has passed, the new lien holder may initiate foreclosure proceedings.

https://www.publicrecords.onlinesearches.com/Foreclosures-and-Tax-Lien-Sales.htm

PA Tax Liens - Pennsylvania Department of Revenue

A lien is defined as a charge on real or personal property for the satisfaction of debt or duty. The Department of Revenue files a lien with the county Prothonotary Office when an individual or business has unpaid delinquent taxes. When a lien is filed, it becomes a matter of public record. The lien ensures the Commonwealth of Pennsylvania is ...

https://www.revenue.pa.gov/Compliance/Liens/Pages/default.aspx

How to Look Up a Federal Tax Lien | Legal Beagle

Federal tax liens are public records. This means that anyone can do a federal tax lien lookup and find outstanding liens, either against themselves or a third party. Tax liens must be officially recorded in order to provide public notice of the government's claim on a taxpayer's property. The liens are recorded with a state recorder's office.

https://legalbeagle.com/6850953-look-up-federal-tax-lien.html

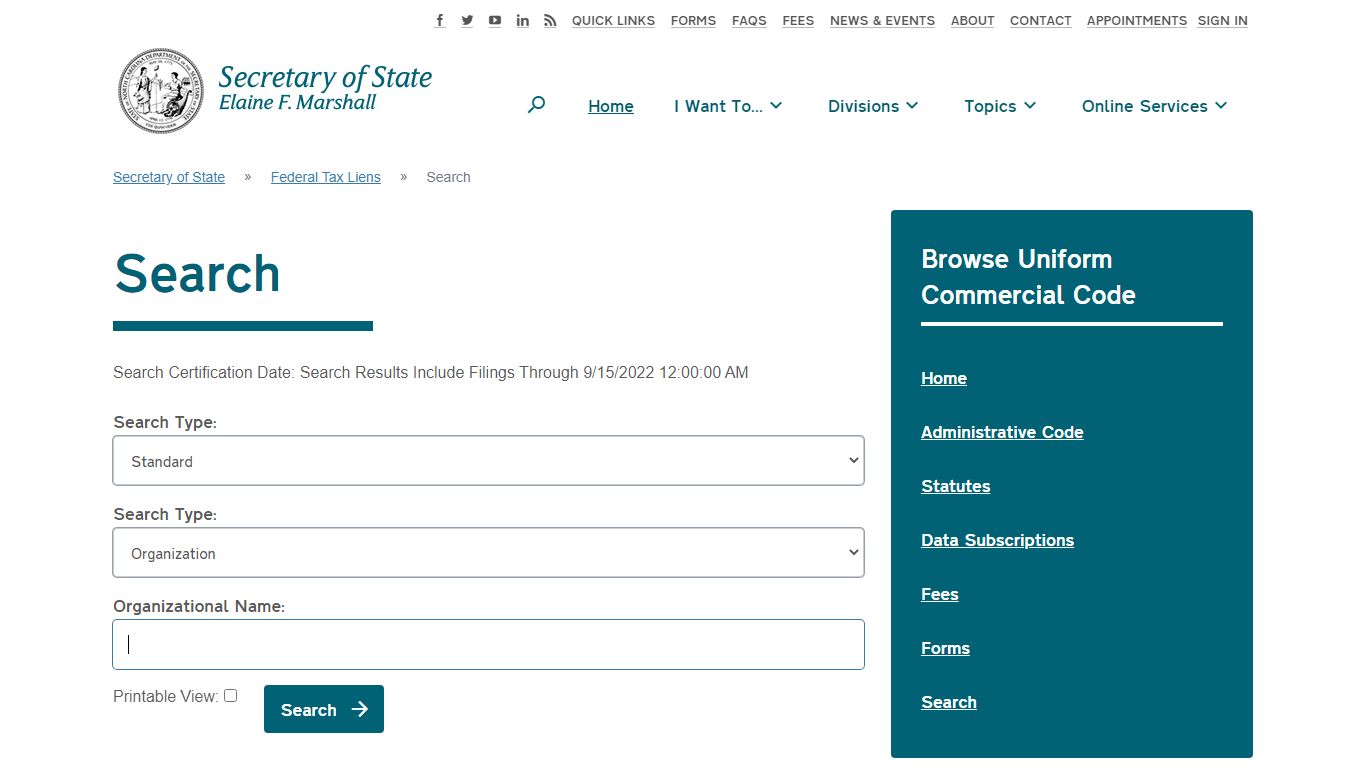

North Carolina Secretary of State Federal Tax Liens Search

Search logic mandated by the UCC Statute and locates exact matches excluding noise words and abbreviations as provided below. Additional tools we provide to help searchers find UCC filings by locating name variations such as: starting with, all words, etc. Indicate the existence or nature of an entity and are ignored in a UCC search.

https://www.sosnc.gov/online_services/search/by_title/_Federal_Tax_Lien

Liens | FTB.ca.gov - California

A lien secures our interest in your property when you don’t pay your tax debt. Once a Notice of State Tax Lien is recorded or filed against you, the lien: Becomes public record Attaches to any California real or personal property you currently own or may acquire in the future Is effective for at least 10 years (may be extended)

https://www.ftb.ca.gov/pay/collections/liens/index.html

Tax Liens - Sacramento County, California

State Tax Liens. California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122 . Employment Development Department (916) 464-2669. Franchise Tax Board (916) 845-4350 or (800) 852-5711 .

https://ccr.saccounty.gov/DocumentRecording/Pages/TaxLiens.aspx

Are IRS Payroll Tax Liens Public Record? - Clean Slate Tax

The short answer, unfortunately, is yes. Tax liens are made to be part of the public record which means anyone can look them up. Because of this, the existence of a tax lien can have a strong negative impact on your credit score. Credit companies will be able to access this information and adjust your credit reputation as a result.

https://cleanslatetax.com/are-irs-payroll-tax-liens-public-record/